Martin Lewis' 'Bonkers' 26-Day Rule to Slash Car Insurance Costs

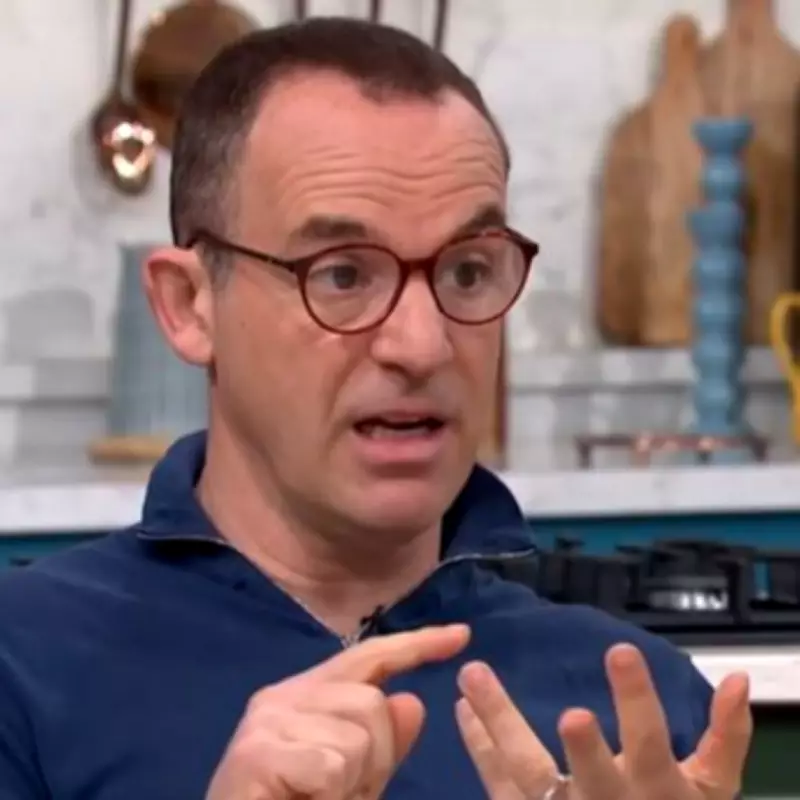

The founder of MoneySavingExpert.com, Martin Lewis, has shared what he describes as a "bonkers" trick that could save British drivers hundreds of pounds on their annual car insurance premiums. Speaking on his ITV programme, The Martin Lewis Money Show, the renowned finance expert highlighted a little-known timing strategy that significantly impacts quote prices.

The 'Sweet Spot' for Insurance Applications

Lewis explained that the exact date you apply for a new car insurance policy can dramatically alter the final cost you are quoted. Based on analysis of millions of insurance quotes, he identified a precise "sweet spot" for securing the best possible rate.

The optimal time to apply is approximately 26 days before your current policy is due to expire. Lewis noted that being a couple of days either side of this 26-day mark does not substantially affect the outcome, but adhering closely to this timeframe is key.

He contrasted this with home insurance, where the ideal application window is slightly earlier, typically around 15 to 20 days before renewal. For car insurance, however, the 26-day rule stands out as a powerful money-saving tactic.

Why This Timing Strategy Works

Martin Lewis delved into the rationale behind this pricing quirk, which stems from how insurance companies assess risk. All insurance pricing is fundamentally based on actuarial risk charts, which classify customers as either good or bad risks based on various behavioural factors.

"The type of people who leave it to the last minute are deemed to be a higher risk than the people who go and get their insurance earlier. So they pay more," Lewis stated. By applying well in advance, drivers can effectively "pervert the system," as he humorously put it, and secure lower premiums by appearing less risky to insurers.

While he acknowledged that this method does not work for every single driver, Lewis emphasised that it has proven effective for a great many people, with potential savings reaching nearly half of the standard quoted price.

Real-World Savings from Viewers

The programme featured compelling testimonials from viewers who successfully implemented the 26-day rule, showcasing substantial financial benefits.

- Selene, aged 63, reported: "Last year I paid £913 for my car insurance. I thought it was because I'm old. Well this year I used your 26-day rule and for the same policy I paid £468, saving me £445 – a 49 per cent saving."

- Nicola shared a similar success story: "Quoted £555 for car insurance, checked it 25 days before and got it for an amazing £222. Thanks for the fantastic information, Martin."

These examples underscore the practical impact of Lewis's advice, demonstrating that proactive timing can lead to dramatic reductions in insurance expenses for motorists across the UK.