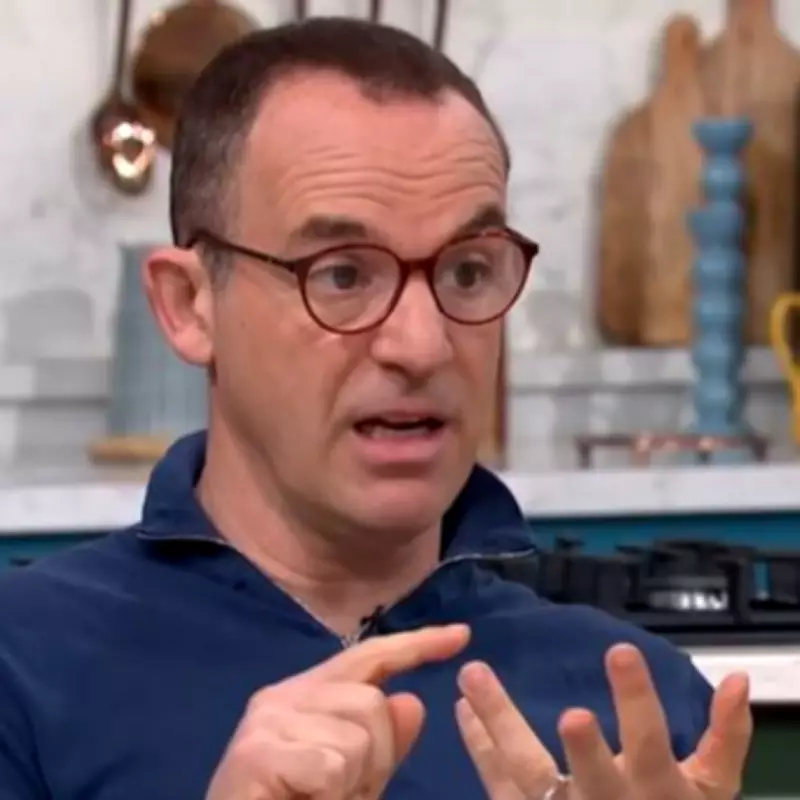

Financial journalist Martin Lewis has delivered crucial guidance to savers across the United Kingdom, specifically addressing a mother seeking to maximise savings for her two ten-year-old children. During his popular BBC Sounds podcast, Lewis responded to a listener's query about tax-efficient saving strategies, sparking an important conversation about investment choices.

Premium Bonds Versus Traditional Savings

The listener explained that her children's junior Individual Savings Accounts (ISAs) had already reached their maximum contribution limits, leading her to allocate £1,500 into Premium Bonds. These government-backed savings products currently offer a prize fund rate of 3.6%, with each £1 Bond presenting a 1 in 22,000 chance of winning a prize. A significant advantage of Premium Bonds is that all prizes, including the coveted £1 million jackpot, remain completely exempt from taxation.

Questioning Tax-Efficiency Priorities

However, Martin Lewis offered a counterintuitive perspective, stating: "I think you may be slightly letting the tax tail wag the dog here. You're putting money into Premium Bonds to avoid tax, but on a zero return, there's nothing to tax." He elaborated with a compelling comparison: "You'd be better off paying 20% tax on a 4% return than no tax on a zero per cent return." This fundamental insight challenges conventional thinking about tax-efficient saving approaches.

Alternative Savings Recommendations

Instead of Premium Bonds, Lewis suggested that the £1,500 could potentially achieve stronger financial results within traditional savings accounts. He specifically highlighted the Nationwide Flex Saver and Halifax Regular Saver as particularly strong options, both offering interest rates around 5% at the time of his recommendation. These accounts provide guaranteed returns rather than the chance-based prize system of Premium Bonds.

Understanding Premium Bonds Limitations

Most Premium Bonds prizes remain relatively small, typically ranging from £25 to £50, which significantly diminishes their benefits for savers primarily seeking tax-efficient growth. Lewis's analysis suggests that for individuals with modest savings amounts, the probability-based returns of Premium Bonds may not justify choosing them over higher-interest traditional accounts, even when considering tax implications.

This financial guidance comes as many UK households continue to navigate challenging economic conditions, seeking optimal ways to protect and grow their savings. Lewis's pragmatic approach emphasises calculating actual returns rather than focusing solely on tax advantages, providing valuable perspective for savers making important financial decisions about their children's futures and their own financial security.