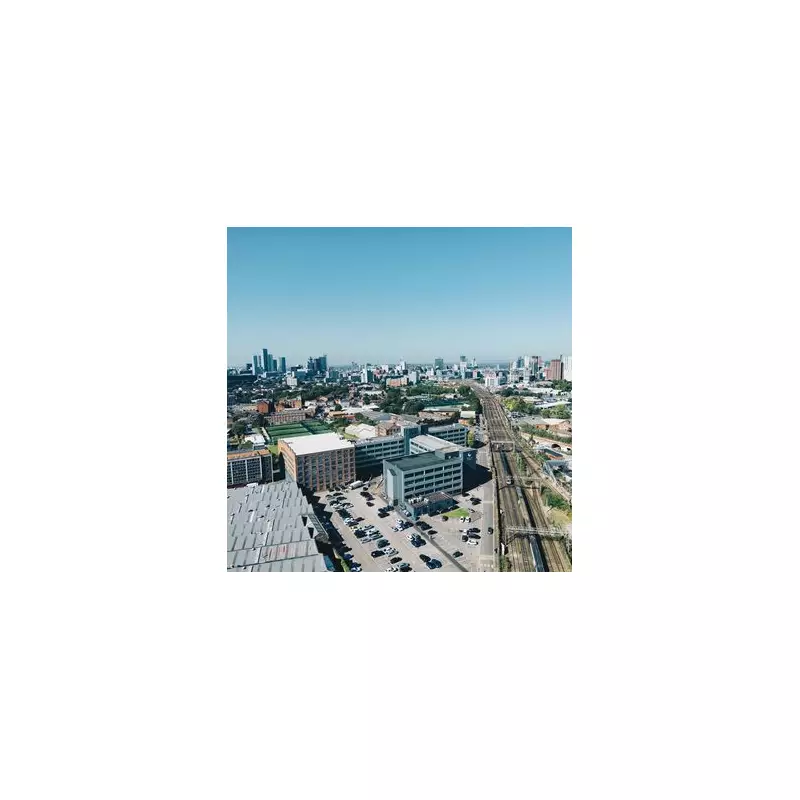

Manchester's prominent property investment specialist, MCR Property Group, has unveiled an ambitious acquisition strategy following a year of strong financial performance and strategic portfolio optimisation.

The company reported a significant increase in net asset value, rising to 63.3p per share from 58.3p, demonstrating robust growth despite challenging market conditions. This impressive performance has positioned the firm for strategic expansion through targeted acquisitions.

Strategic Portfolio Repositioning

Throughout the financial year, MCR Property Group successfully executed a comprehensive portfolio repositioning strategy. The company disposed of several mature investments, generating substantial proceeds that will fuel future growth initiatives. This strategic approach has strengthened the company's financial foundation while creating capacity for new investment opportunities.

Dividend Growth and Shareholder Returns

Reflecting confidence in its financial health and future prospects, the company announced an increased final dividend of 1.75p per share. This brings the total dividend for the year to 2.75p per share, representing a notable 10% increase compared to the previous year. The consistent dividend growth underscores the company's commitment to delivering shareholder value.

Future Acquisition Focus

Looking ahead, MCR Property Group has identified several key sectors for potential acquisitions. The company plans to target residential assets, student accommodation, and healthcare properties – sectors demonstrating strong fundamentals and growth potential in the current market environment.

Matthew Roberts, Chief Executive of MCR Property Group, expressed optimism about the company's prospects: "Our strong financial performance and successful portfolio repositioning have created a solid platform for future growth. We are now well-positioned to pursue attractive acquisition opportunities that align with our strategic objectives and will drive continued value creation for our shareholders."

Market Position and Outlook

The company's strategic focus on sectors with defensive characteristics and growth potential positions it well to navigate ongoing market uncertainties. With a strengthened balance sheet and clear acquisition strategy, MCR Property Group aims to capitalise on emerging opportunities in the UK property market while maintaining its track record of delivering consistent returns to investors.