Pensioners Face Tax on State Pension Due to Triple Lock

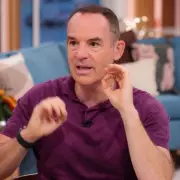

Rising State Pension values, driven by the Triple Lock, could soon push retirees over the frozen tax threshold. Martin Lewis's Cash ISA tip may offer a solution. Learn how to protect your income.