When Nicky Wake's husband Andy suffered a devastating heart attack that left him brain-damaged, she believed the medical crisis would be their biggest challenge. Instead, she discovered that failing to complete a simple £82 form would plunge her into a financial nightmare that cost her £20,000.

The tragedy that sparked a financial crisis

Nicky describes Andy as the love of her life, with the couple marrying after just one year together. They built a life that included their son Finn and ran a successful business called Don't Panic Events. However, when Andy suffered a series of heart attacks that caused brain damage, their world collapsed.

"It was hell on earth," Nicky recalls. "I was fighting possibly the biggest battle of my life – I'd lost my soulmate very suddenly. Then I was wasting tens of thousands of pounds to access money that was legally mine."

The £82 document that could have saved everything

The couple had never established a Lasting Power of Attorney (LPA), a legal document that would have given Nicky authority to manage their joint finances after Andy lost mental capacity. While the forms themselves are free, registering one with the Office of the Public Guardian costs just £82.

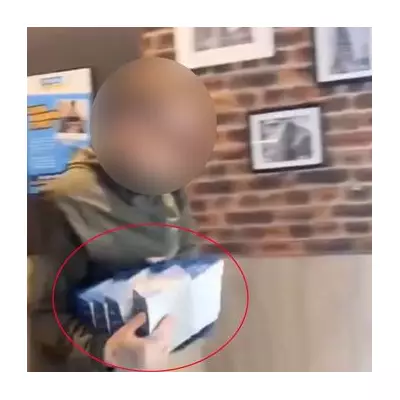

Without this protection, Nicky found herself trapped in bureaucracy. "If Finn needed school shoes or I was getting him a birthday present, I needed to keep the receipt," she explains. "Every year, I had to submit receipts for expenditure."

The emotional toll became unbearable as she compiled the paperwork. "I remember sobbing in the kitchen once while putting together the paperwork at the end of the year because each receipt reminded me that Andy couldn't be there for those moments."

Experts warn: Don't make this common mistake

Legal professionals emphasise how crucial LPAs are for family protection. Esther Trevelyan, head of private client at HCB Widdows Mason, explains: "Without access to a person's funds in their sole name, this can leave bills unpaid and the family could end up dealing with debt recovery teams or being inundated with correspondence, which can make an already difficult time much more stressful."

Hudda Morgan from Spencer West LLP compares the document to essential insurance. "Making powers of attorney is much easier when you are fit and well, much harder if health and mental capacity are diminished," she advises. "It's one of those things like an insurance policy – make it when you're well, stick it in a drawer and forget about it, and hopefully you'll never need it."

Nicky's experience serves as a stark warning to other families. "The amount of money I wasted and sleepless nights I went through was heartbreaking – I don't want anyone else to go through what I did." Her message is clear: that simple £82 form could save your family from both financial ruin and additional heartache during life's most challenging moments.