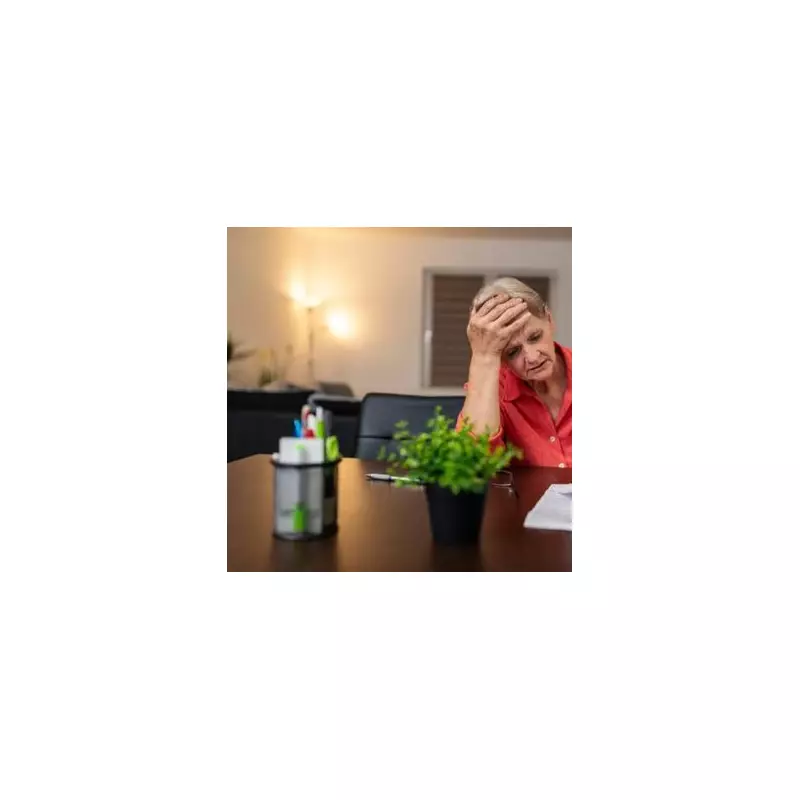

Nearly 8.5 million state pensioners across Britain are facing a financial nightmare as the government's cherished triple lock commitment hangs in the balance, threatening to derail retirement plans and push household budgets to breaking point.

What the Triple Lock Crisis Means for Your Pocket

New analysis reveals that if the government abandons its triple lock pledge, pensioners could miss out on a significant income boost they would otherwise receive. The triple lock mechanism, which guarantees state pensions rise by the highest of three measures - average earnings growth, inflation or 2.5% - has become a political battleground as costs soar.

The Numbers Behind the Pension Predicament

Official statistics from the Department for Work and Pensions show the staggering scale of this potential financial blow. With 8.46 million people currently receiving the state pension, any reduction in the expected increase would have widespread consequences for retirement households already struggling with escalating living costs.

The situation has created a perfect storm for policymakers, who must balance protecting pensioner incomes against the mounting pressure on public finances. Many retirees rely on the state pension as their primary source of income, making any reduction in expected increases particularly devastating.

Why This Matters Beyond the Headlines

This isn't just about percentage points and political promises - it's about real people facing difficult choices between heating and eating. The potential breaking of the triple lock comes at a time when energy bills are skyrocketing and food costs are climbing relentlessly.

Pensioner advocacy groups have expressed deep concern about the impact on the most vulnerable retirees, particularly those without substantial private pension savings to fall back on. The state pension represents a lifeline for millions, and any reduction in expected income could push many into financial hardship.

The Political Tightrope

The government faces an unenviable decision: honour a costly manifesto commitment or make savings that would directly impact millions of voters. With both economic and political consequences at stake, the outcome of this debate will shape retirement living standards for years to come.

As autumn approaches, when the decision on next year's pension increase is typically announced, millions of pensioners will be watching Westminster closely, hoping their financial security doesn't become collateral damage in Britain's cost of living battle.