Birmingham City Council has formally approved the sale of the city's iconic Alpha Tower, a major step in its efforts to manage a severe financial crisis. The decision was made during a council meeting this week, marking another high-profile asset disposal since the Labour-run authority declared itself effectively bankrupt in September 2023.

A Landmark Sale for Financial Recovery

The council's relevant committee was recommended to proceed with the freehold sale of Alpha Tower on Suffolk Street Queensway to assist with the local authority's financial recovery plan. Since the start of last year, a huge range of council-owned properties and land have been sold to generate essential capital.

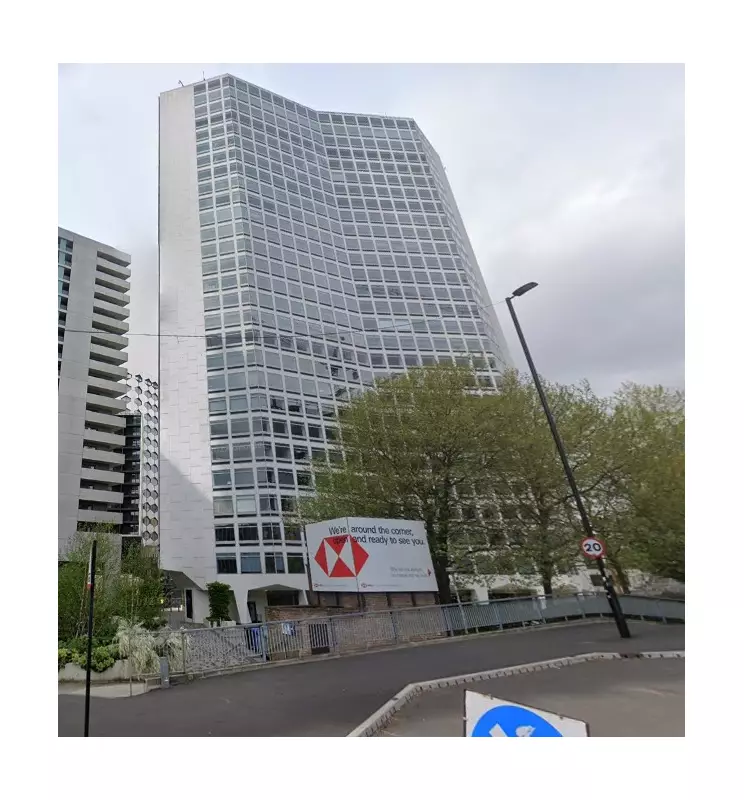

Alpha Tower, one of Birmingham's tallest buildings, was granted Grade II Listed status in 2014. Originally conceived as a headquarters for an independent television company, it is now marketed as a base for dynamic businesses. The council currently owns the freehold, while the building is subject to a long lease to an existing leaseholder.

Mixed Reactions from City Leaders

The decision to sell the landmark prompted regret from some councillors. Labour cabinet member for finance, Karen McCarthy, commented at the meeting, "This is the one that makes me go 'do we have to?' It's an iconic building [...] but it's very clearly in scope."

Ward councillor Albert Bore said he was "sorry that the Birmingham City Council is giving up the freehold of buildings such as Alpha Tower," but accepted the "financial necessity for doing so." In contrast, Conservative councillor Robert Alden offered a pragmatic view: "Being blunt, I'd rather we sold this than a community library so given where the council is, this is a sensible thing to be looking at."

The Financial Imperative Behind the Decision

Council documents stated that while the authority is "under no obligation to proceed with the proposal and would suffer no reputational consequences if it did not proceed," failing to act would have significant financial downsides. The 'significant' capital receipt from the sale would not be realised, depriving the council of funds needed for its recovery plan, with no guarantee of a future sale opportunity.

The council also noted that due to the existing long lease, it would be unlikely to reuse or develop the tower itself. The immediate financial gain from the sale was deemed "more attractive" than continuing to collect ongoing ground rent. This latest approval adds Alpha Tower to the growing list of assets sold by Birmingham City Council as it navigates its unprecedented financial challenges.