Millions of households across the United Kingdom are set to face a significant financial squeeze in 2026 as a series of tax changes announced by Chancellor Rachel Reeves come into effect. The Labour government's fiscal plans, detailed in the recent Spending Review, outline multiple avenues through which the tax burden on individuals and families is poised to increase.

Frozen Thresholds and Stealth Taxes

The cornerstone of the rising tax take is the extension of the freeze on personal allowances and other key tax thresholds. Originally implemented until 2025-26 and later extended to 2027-28 by the previous Conservative administration, Chancellor Reeves is now likely to prolong this freeze beyond 2028. This policy, initially expected to raise limited revenue, has been supercharged by high inflation, almost tripling its yield and dragging more people into higher tax brackets as their nominal wages rise.

This freeze reverses around half of the real-term gains taxpayers enjoyed from sharp increases in the personal allowance during the 2010s. The cumulative effect, combined with sustained inflation since 2021, is a major contributor to the tax burden reaching a post-war high by 2026-27.

Direct Tax Increases on Income and Investments

From April 2026, taxpayers will face direct hikes in several areas. The rate of tax on dividend income will rise substantially. For basic-rate taxpayers, the rate increases from 8.75% to 10.75%, while higher-rate taxpayers will see their rate jump from 33.75% to 35.75%. The additional rate remains at 39.35%.

A year later, in April 2027, further increases will hit savings and property income. The basic rate will rise to 22%, the higher rate to 42%, and the additional rate to 47%. These moves are predicted to impact savers, investors, and buy-to-let landlords severely, potentially accelerating exits from the rental market. Consequently, pensions and ISAs will become even more critical for shielding money from taxation.

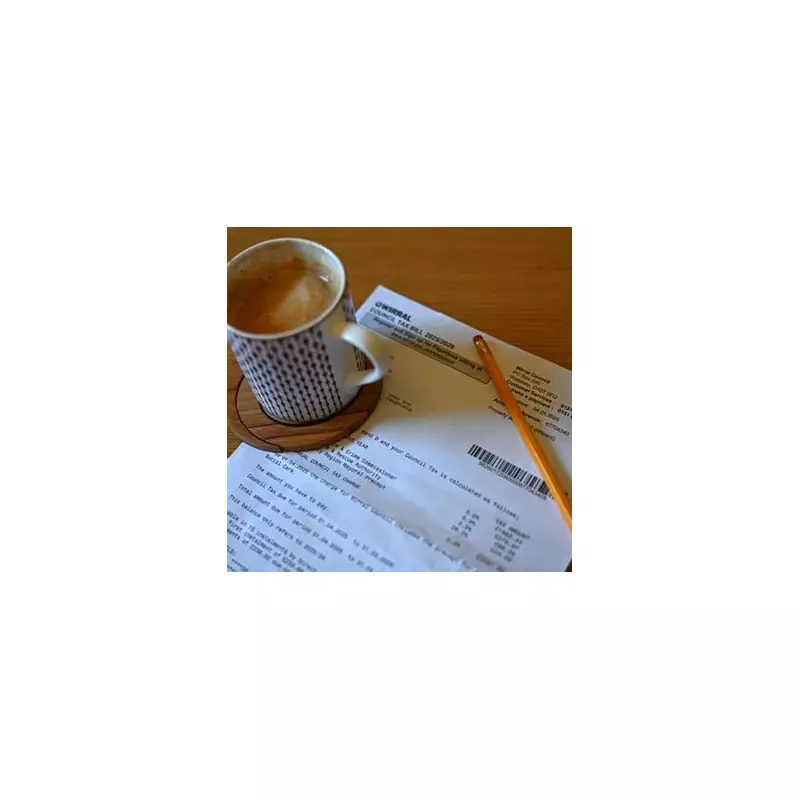

Council Tax, Fuel, and Sin Taxes

Local authorities are expected to utilise their power to raise council tax by up to 5% annually to fund local services and increased police budgets, leading to steadily climbing bills for homeowners.

While an immediate fuel duty hike has been ruled out, a 'staged increase' will begin from September 2026. This will gradually phase out the 5p per litre cut introduced in 2022, a measure originally designed to combat soaring prices after Russia's invasion of Ukraine. The move aims to recoup an estimated £3 billion in lost Treasury revenue.

Furthermore, duty on alcohol will rise in line with RPI inflation from February 2026. Tobacco duty, which normally rises each November, will increase by RPI plus two percentage points. A new tax on vaping products will also be introduced in October 2026, charged at £2.20 per 10ml of vaping liquid.

Broader Implications for Household Finances

The combined impact of these seven measures represents a substantial financial headwind for UK households. The freeze on thresholds acts as a persistent stealth tax, while the direct increases on dividends, savings, and property income target investment returns and secondary income streams. The rises in council tax and duties on fuel, alcohol, tobacco, and vaping will directly increase the cost of living.

With the Chancellor reportedly needing to find £20 to £30 billion to cover public spending commitments, these tax rises underscore the tightening fiscal environment. Households are advised to review their financial planning, maximise the use of tax-efficient wrappers like ISAs, and prepare for a higher overall cost of living from 2026 onwards.