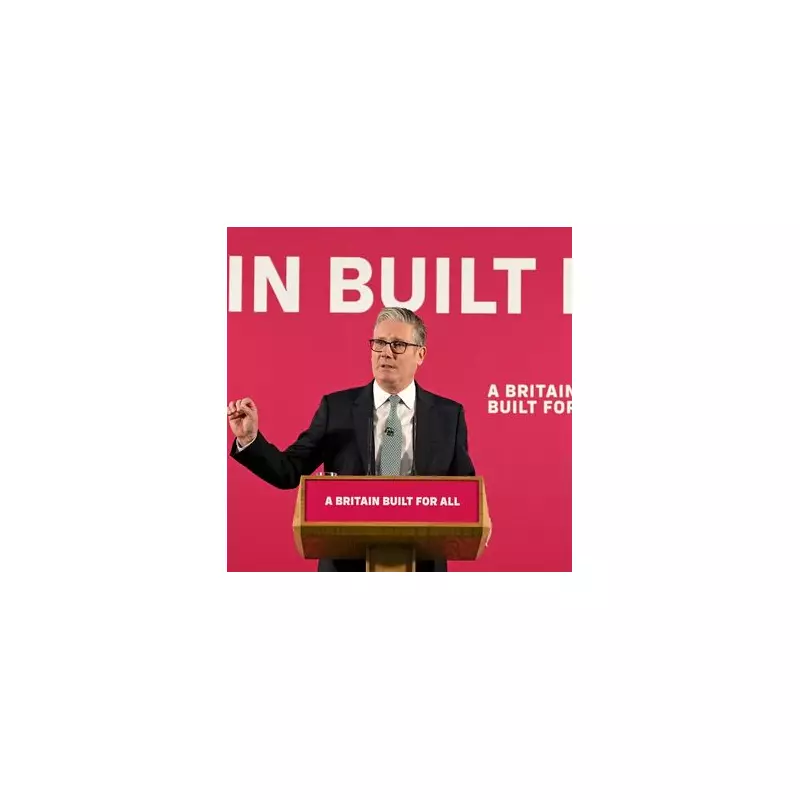

Prime Minister Sir Keir Starmer has publicly defended the government's decision to implement significant tax increases, outlined in Chancellor Rachel Reeves' Autumn Budget last week.

Defending the Fiscal Choices

Speaking on December 1, the Labour leader addressed the controversial measures, which are projected to raise £26 billion. He argued that the alternative paths of cutting public services or increasing borrowing were not viable options for the country's future.

Sir Keir stated that the reforms were essential to improve Britain's public services and tackle entrenched poverty. He acknowledged the direct financial impact on citizens but insisted the government had made the correct choice.

The Path Not Taken

"Politics is always about making choices," the Prime Minister said. "We could have cut public services. We could have ignored child poverty. We could have rolled the dice with extra borrowing."

He strongly criticised the prospect of further government debt, linking it directly to the economic turmoil experienced during Liz Truss's brief premiership. "That is the path that Liz Truss took, and you can see the cost in any bill, mortgage, carload, anything affected by interest rates," he added.

Funding Key Policy Reversals

According to reports, the tax measures will help fund two major policy shifts:

- The scrapping of the controversial two-child benefit limit.

- Support for cutting household energy bills.

Sir Keir expressed his "personal pride" in the Budget delivered by Chancellor Reeves on November 26. He framed it as a central part of a plan to rebuild the country and unlock potential for every community.

"I do not want to see a country where children grow up in poverty," he stated emphatically. "It is a fundamental British belief that every child should go as far as that talent will take them, and poverty is a barrier to that."

The Prime Minister concluded by positioning the Budget as a necessary step to address the cost of living crisis, fix public services, and reignite growth in regions that have been historically overlooked.