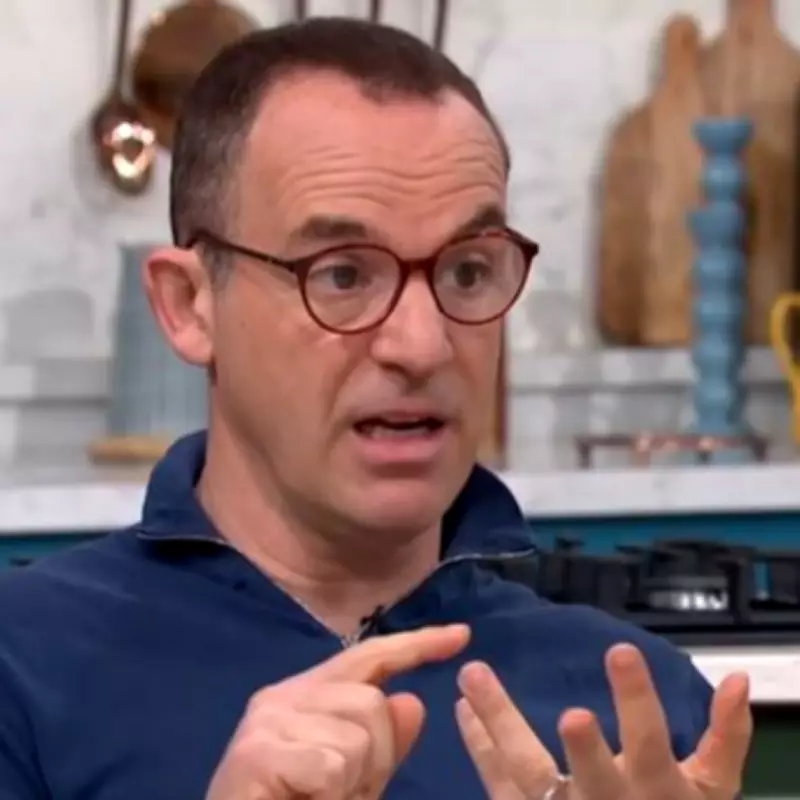

Martin Lewis Highlights Three Major UK Banks with Lucrative Switching Offers

Financial expert Martin Lewis and his team at MoneySavingExpert.com have identified three prominent UK banks currently providing customers with switching incentives of up to £225. These offers are designed to attract new account holders with substantial cash bonuses and a range of additional benefits.

Santander Edge Explorer Account: £225 Bonus

The Santander Edge Explorer account stands out with a total offer of £225. To qualify, customers must pay in a one-off amount of £1,500 or more within 60 days, which triggers a £200 cash payment. Additionally, a £25 Amazon voucher is included as part of the incentive.

This account comes with several notable perks:

- Access to 24/7 remote family GP services for medical consultations.

- A competitive 6% interest rate on savings up to £4,000 for the first year.

- Cashback of 1% on bills paid by Direct Debit, with a maximum of £10 per month.

- Cashback of 1% on supermarket and travel purchases made with the debit card, also capped at £10 monthly.

Santander notes that a monthly fee of £17 applies to this account. Existing Santander current account holders can easily switch to the Edge Explorer account through the Mobile Banking app or Online Banking, retaining their account number, card, and PIN for convenience.

Nationwide FlexPlus Account: £175 Bonus

Nationwide's FlexPlus account offers a £175 switching bonus. To earn this, customers need to deposit a one-off sum of £1,000 or more and make at least one debit card transaction within 31 days of opening the account.

Key features of this account include:

- A high-interest rate of 6.5% on savings up to £200 per month for one year, potentially yielding up to £84 in annual interest.

- Fee-free overseas spending, making it an attractive option for travelers.

Co-op Bank Everyday Extra Account: £175 Bonus

The Co-op Bank Everyday Extra account provides a total bonus of £175, structured in two parts. Customers receive £100 after paying in £1,000 or more and using their debit card at least 10 times within the first 30 days.

To claim the remaining £75, account holders must repeat this process for three consecutive months, earning £25 each month. This account also includes a linked savings option with a 7% interest rate on deposits of up to £250 per month, offering a maximum annual interest of £114.

These switching deals from Santander, Nationwide, and Co-op Bank present significant opportunities for consumers looking to maximize their banking benefits. With cash incentives and valuable perks like high-interest savings and cashback, these offers are worth considering for anyone seeking to enhance their financial setup.