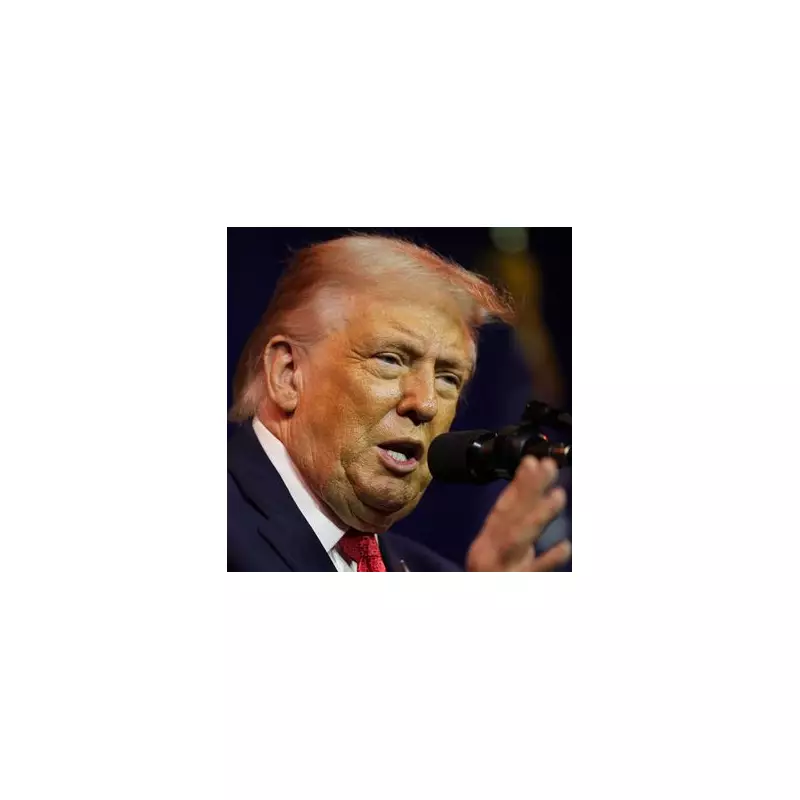

Oil prices have fallen sharply following military action by former US President Donald Trump in Venezuela, a development experts say will help cut inflation and reduce fuel and energy costs for households across the United Kingdom.

Market Shockwaves from Venezuela

The trigger for the market shift was the capture of Venezuelan President Nicolás Maduro and his wife last week, who are now being held in New York. The United States has subsequently asserted control over Venezuela's vast crude oil reserves, which are the largest in the world.

In a significant statement, Donald Trump announced that Venezuela would turn over sanctioned oil to the US to be sold at market rates. This immediately sparked concerns about a potential global oversupply of oil, particularly amid existing worries about weak demand.

FTSE Giants Tumble as Oil Prices Slide

The financial impact was felt instantly in London. The price of a barrel of oil dropped from $58 to $56 in the days following the announcement, with analysts forecasting further declines.

Shares in UK-based oil majors Shell and BP fell by 2.4% and 3.2% respectively in early trading. The steep drop in these FTSE 100 heavyweights was the primary factor pulling the main UK index down by approximately 0.5%.

Cheaper Oil to Ease Cost of Living Pressures

While challenging for oil company shareholders, the falling price of crude is expected to bring welcome relief for UK consumers and businesses. Energy analysts have directly linked the trend to lower future inflation and reduced household bills.

Melvyn Wilson, an Energy Trader at Troo Ltd, explained the situation to Newspage: "Oil prices have eased after President Trump said Venezuela would hand over about 50 million barrels of crude to the US. That’s stirred worries about oversupply at a time of weak demand."

He outlined the dual effect for the UK: "For the UK, cheaper oil cuts inflation, eases fuel and energy bills, and lowers costs for businesses." However, he also issued a note of caution regarding the domestic energy sector, stating it "pressures the North Sea, with risks to jobs, investment, and tax receipts."

Wilson concluded with a warning about broader economic risks, saying, "If prices drop too fast while demand stays soft, deflationary pressure is a risk." His analysis aligns with earlier warnings from investment bank Morgan Stanley, which predicted an oil surplus in the first half of 2026.

The coming weeks will determine the full impact on global markets and the extent of the savings passed on to UK consumers struggling with high energy costs.