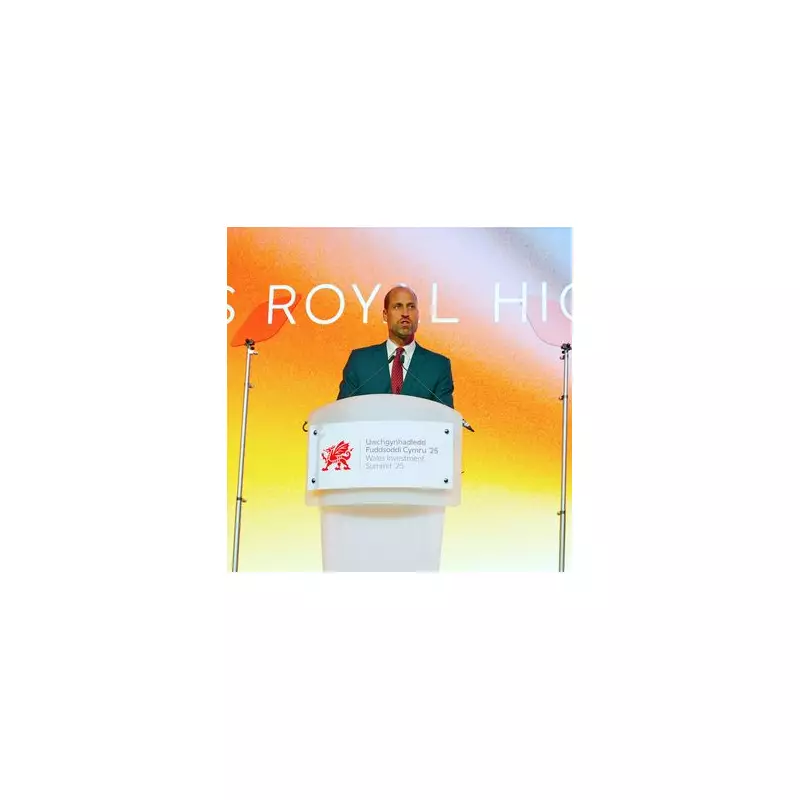

This week's Wales Investment Summit made headlines with a bold announcement of over £16bn of investment linked to projects being showcased to global investors, promising to create around 10,000 jobs. While presented as a transformative moment for the Welsh economy, a deeper analysis suggests the substance may not match the political presentation.

Unpacking the £16bn Investment and Job Claims

A significant portion of the promoted investments, from firms like Vantage Data Centers, Vodafone, RWE, GE Aerospace, and Eni, have been public knowledge for the past year. The summit did not generate these commitments but assembled them into a single narrative, blurring the line between new activity and the rebranding of existing plans.

The headline figure of 10,000 jobs is also nuanced. The majority are temporary construction roles, with far fewer permanent positions available after projects are built. For instance, the largest single project—Vantage's £10bn data centre programme in South Wales—may ultimately support only around 500 long-term jobs.

Furthermore, Wales cannot yet guarantee how many construction jobs will go to local workers. Specialist contractors, often based outside Wales or overseas, are typically required for major data centre and energy projects. This means a significant portion of the employment impact could be captured outside the Welsh economy.

The Real Economic Value for Wales

The core issue lies in how much economic value, or Gross Value Added (GVA), Wales will actually retain from the £16bn headline. Much of the spending—on servers, infrastructure, components, and specialist contractors—flows immediately out of Wales. Profits from capital-intensive projects are also repatriated to owners headquartered elsewhere.

Applying realistic GVA conversion rates suggests the true economic value retained in Wales over the next four years will be between £1.2bn and £1.8bn, not £16bn. This figure is put into stark perspective by the closure of primary steelmaking at Tata Steel in Port Talbot, which previously contributed around £1.6bn of GVA annually.

With the transition to an electric arc furnace still years away, Wales is losing roughly £1.3bn to £1.4bn in output each year. Over four years, that loss exceeds £5bn, meaning the real value of the entire £16bn investment pipeline is substantially smaller than the impact of losing a single major employer.

The Case for Cultivating Welsh Fast-Growth Firms

The analysis points to an alternative and potentially more fruitful path for economic transformation: supporting home-grown, fast-growing Welsh businesses. Research indicates that an average growth business contributes around £12m of GVA over four years. To match the real economic value of the government's £16bn pipeline, Wales would need to cultivate roughly 150 such firms.

Evidence suggests this is achievable. The 2025 Wales Fast Growth 50 list, featuring the nation's fastest-growing companies, saw collective turnover surge from £312m in 2022 to over £1.05bn in 2024—an increase of £740m. These fifty firms now contribute an estimated £420m of GVA to the Welsh economy annually.

Projected conservatively over the next four years, these businesses alone are likely to generate between £1.6bn and £2bn of economic value—roughly equivalent to the entire GVA impact of the £16bn summit pipeline. This underscores that scaling Welsh companies delivers more genuine, retained economic transformation than re-announced capital projects.

Therefore, if Wales is serious about economic transformation, it requires a deliberate, coordinated scale-up strategy. This must strengthen access to patient capital, deepen university-industry partnerships, build a skilled workforce pipeline, and improve digital infrastructure to help ambitious companies invest, innovate, and stay in Wales.

While the Wales Investment Summit helps raise the country's profile, the long-term health of the economy will depend less on the size of inward investment headlines and far more on whether Wales can generate hundreds of high-growth firms in the years ahead.