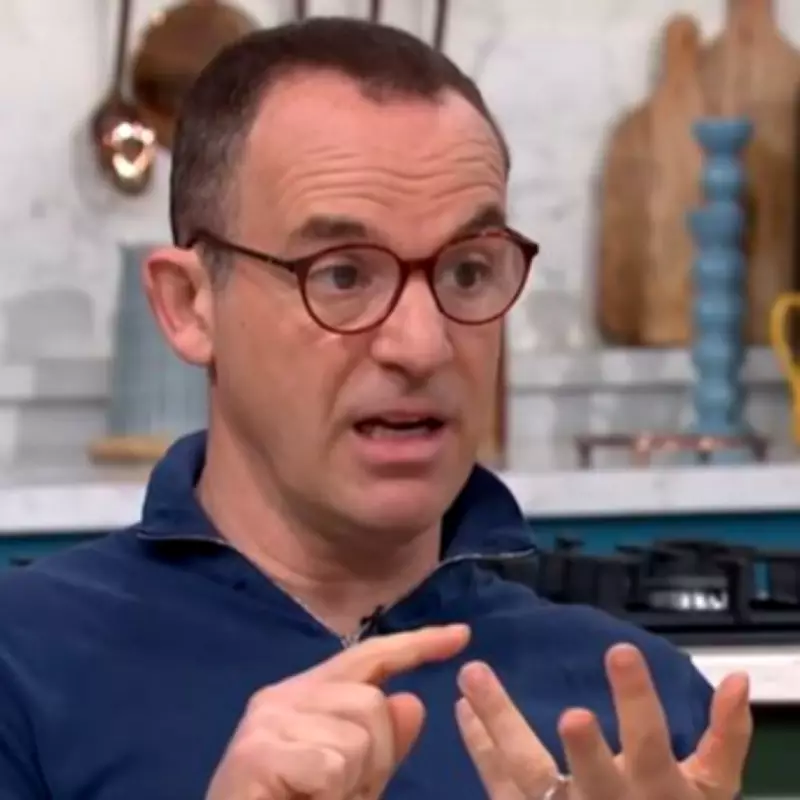

Financial guru Martin Lewis has publicly endorsed a pensioner's pragmatic approach to retirement spending, highlighting a philosophy that balances future security with present enjoyment. The founder of MoneySavingExpert.com discussed the topic in detail on his popular BBC Sounds podcast, sharing broader savings strategies that include starting pension contributions early in one's career.

A Listener's Perspective Gains Expert Approval

During the podcast, a listener named Chris, aged 62, presented a personal spending policy that resonated strongly with Lewis. Chris explained his rationale, stating: "My policy is to enjoy now the money I've saved as in another 15 or 20 years, I might not be able to, or wish to enjoy the things or visit the places I want to now."

Martin Lewis responded with enthusiastic agreement, remarking: "I absolutely agree, funnily enough. Money is about utility and happiness." He elaborated on this principle, advocating for a balanced financial strategy.

The Core Principle: Strategic Spending for Happiness

Lewis emphasised that prudent financial management involves careful planning for potential future hardships while also allowing for current fulfilment. "You need to plan and be prepared for the worst to happen, and have the contingencies available," he advised.

He continued to outline his philosophy: "But actually spending wisely, checking that you are doing things efficiently, not wasting money on things that don't give you happiness or value, or at least getting the things that you need and the necessities, not joyful things, as cheaply as possible in a way that works, is what enables you to spend the money on the things that you want to, to give you a better life." This approach champions efficiency in covering essential costs to liberate funds for meaningful experiences.

Understanding the State Pension Context

This discussion on personal retirement strategy unfolds against the backdrop of the UK's evolving state pension system. The state pension age is currently 66, but is scheduled to increase in stages, beginning in April 2026 and reaching 67 by April 2028.

To qualify for the full new state pension, individuals typically require 35 years of National Insurance contributions. The full weekly rate is set to rise from £230.25 to £241.30 in April this year, in accordance with the government's triple lock policy. This change represents a 4.8 percent increase in state pension payments, designed to help maintain pensioners' purchasing power.

Lewis's endorsement of a balanced spending approach provides a personal counterpoint to these systemic financial provisions, encouraging individuals to think proactively about how they use their resources throughout their retirement years.