HMRC Tax Calculator Error Risks Fines for Workers

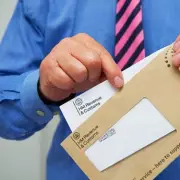

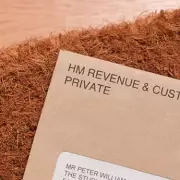

HMRC's self-assessment tax calculator uses outdated data, failing to reflect recent Capital Gains Tax hikes. Experts warn this could lead to incorrect filings and penalties. Discover how to protect yourself.